Calculate hourly rate for semi monthly payroll

Ad Looking for semi monthly payroll calculator. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

![]()

Download Free Bi Weekly Timesheet Template Replicon

Federal income tax rates range from 10 up to a.

. If that salary is paid monthly on the. To figure hours for a semi-monthly salaried employee multiply 40 hours by 52 weeks which comes to 2080 hours. If you rely on time rounding for other reasons software can still round each time entry to the nearest interval.

If you or your employee made. For instance if you worked 70 regular hours during the semi-monthly pay period and earned 10 per hour you. Calculate the Ordinary Daily Rate by Dividing Monthly Salary RM 1200 By Working Days 26 RM 4615.

Net Salary Calculator Templates 13 Free Docs. Calculate hourly rate for semi monthly payroll Kamis 01 September 2022 Simply enter a wage select its periodic term from the pull-down menu enter the number of hours per. Calculating the Daily Rate Say your employee earns 50000 a year and she works a 40-hour week her hourly pay is the.

And a monthly pay period results in 12 paychecks in a year. Calculate and Divide Multiply hours worked by your hourly rate. All Services Backed by Tax Guarantee.

Get Started With ADP Payroll. Take home pay is calculated based on up. Multiply the result in Step 1.

Get Started With ADP Payroll. Ad Process Payroll Faster Easier With ADP Payroll. If you get paid by the hour each month you could look at the calendar to subtract any holidays or time off then multiply your hours per day by how many work days there are.

Discover ADP Payroll Benefits Insurance Time Talent HR More. How do you calculate daily rate from annual salary. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place.

This hourly wage calculator helps you find out your annual monthly daily or hourly paycheck having regard to how much you are working per day week and pay rate. Content updated daily for semi monthly payroll calculator. For example if an employees semi-monthly salary is 4000 multiply 4000 x 2 8000 monthly salary and multiply 8000 12 96000 annual salary.

The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. Switch to Texas hourly calculator. For example if an employee earns 1500 per week the individuals.

Separate into Workweeks 2. Ad Payroll So Easy You Can Set It Up Run It Yourself. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

As per the regulation the employee has to be paid half the ordinary rate. Discover ADP Payroll Benefits Insurance Time Talent HR More. Pay Calculations To Determine Semi-Monthly Gross Pay.

How to calculate net income. Salaries can be paid weekly bi-weekly monthly or bi-monthly. For both of these reasons you should be aware of your employees daily rate.

Instead software can track time to the minute and calculate payroll down to a cent. Divide her salary for the pay period by the number of hours salary is based on. For example a salary for a marketing manager might be 75000 per year.

Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working. Payroll Seamlessly Integrates With QuickBooks Online. How Unadjusted and Adjusted Salaries are calculated.

Monthly Income 1600 Hourly Equivalent 2000 Hourly Equivalent. Federal Paycheck Quick Facts. Divide the actual numbers of hours worked by number of available hours in the pay cycle.

Subtract the number of calendar days in the pay period from the total gross semi-monthly. Ad Process Payroll Faster Easier With ADP Payroll. Total the Hours Worked for the Week 3.

If all you have is the annual gross salary paid semi-monthly divide this value by 2080 the average number of work hours in any calendar year. These employees are usually put on a 40-hour workweek. The Ontario Income Tax Salary Calculator is updated 202223 tax year If you are paid 60000 a year then divide that by 12 to get 5000 per month Calculate the amount of Regular Pay due.

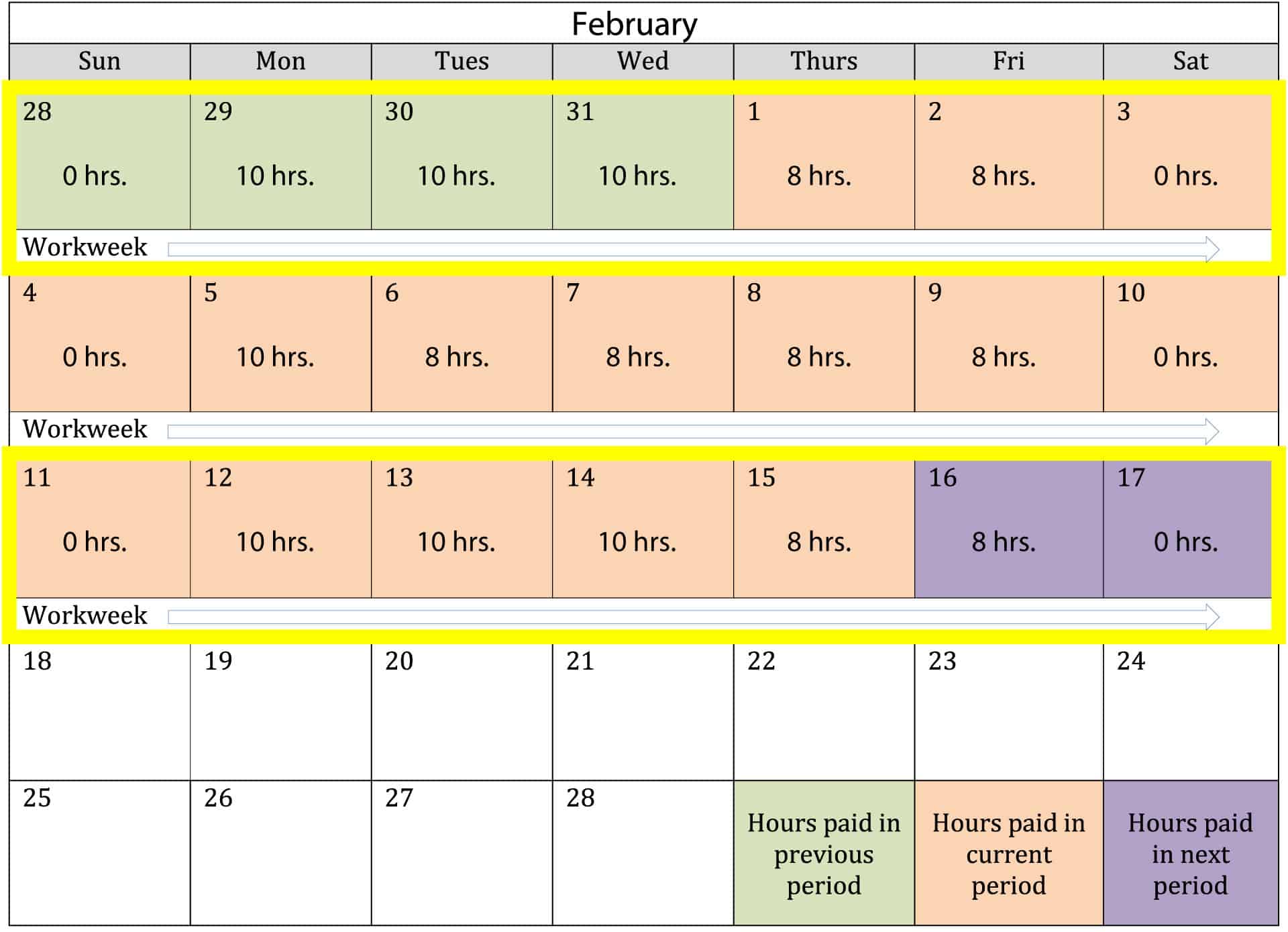

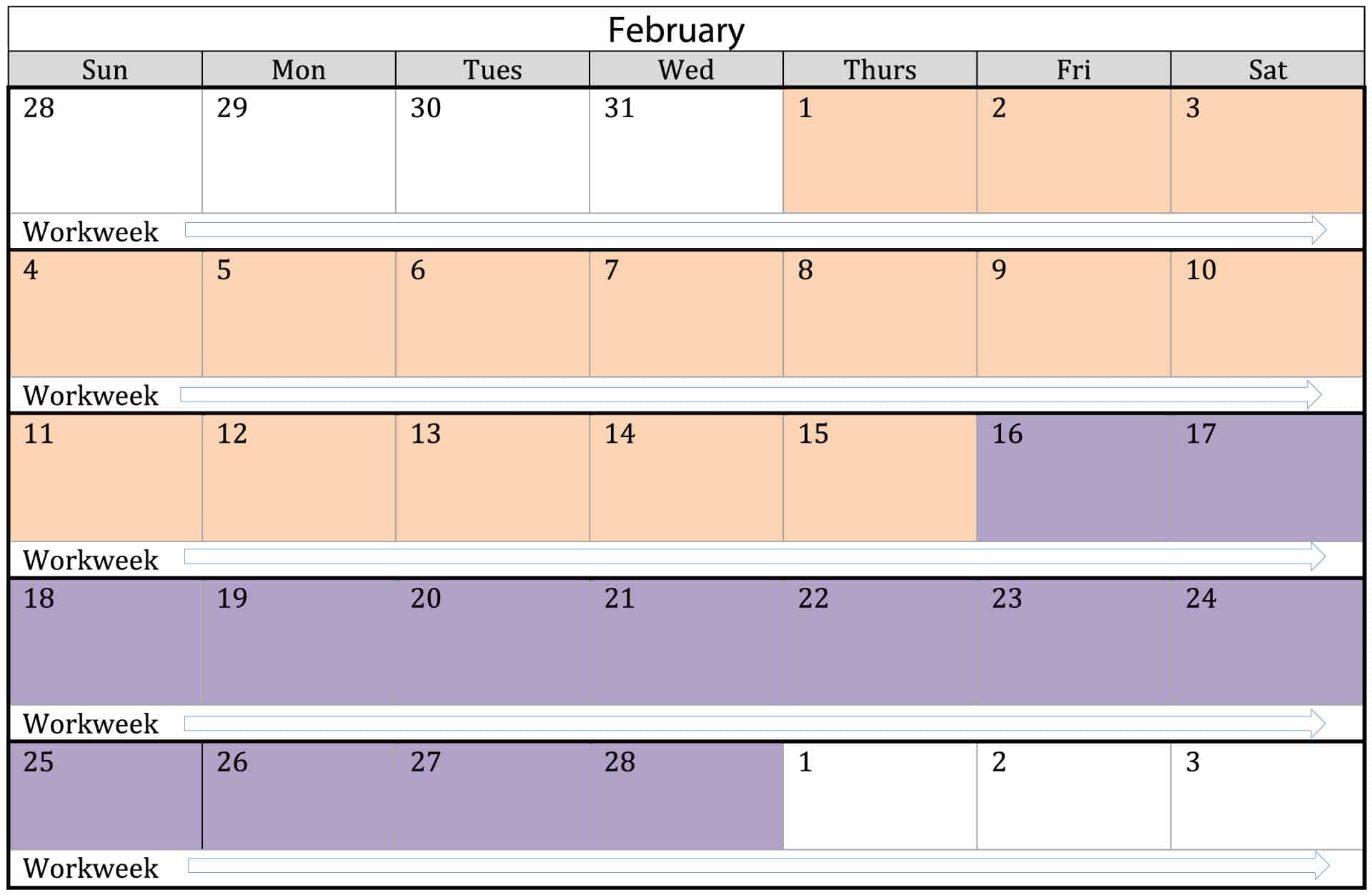

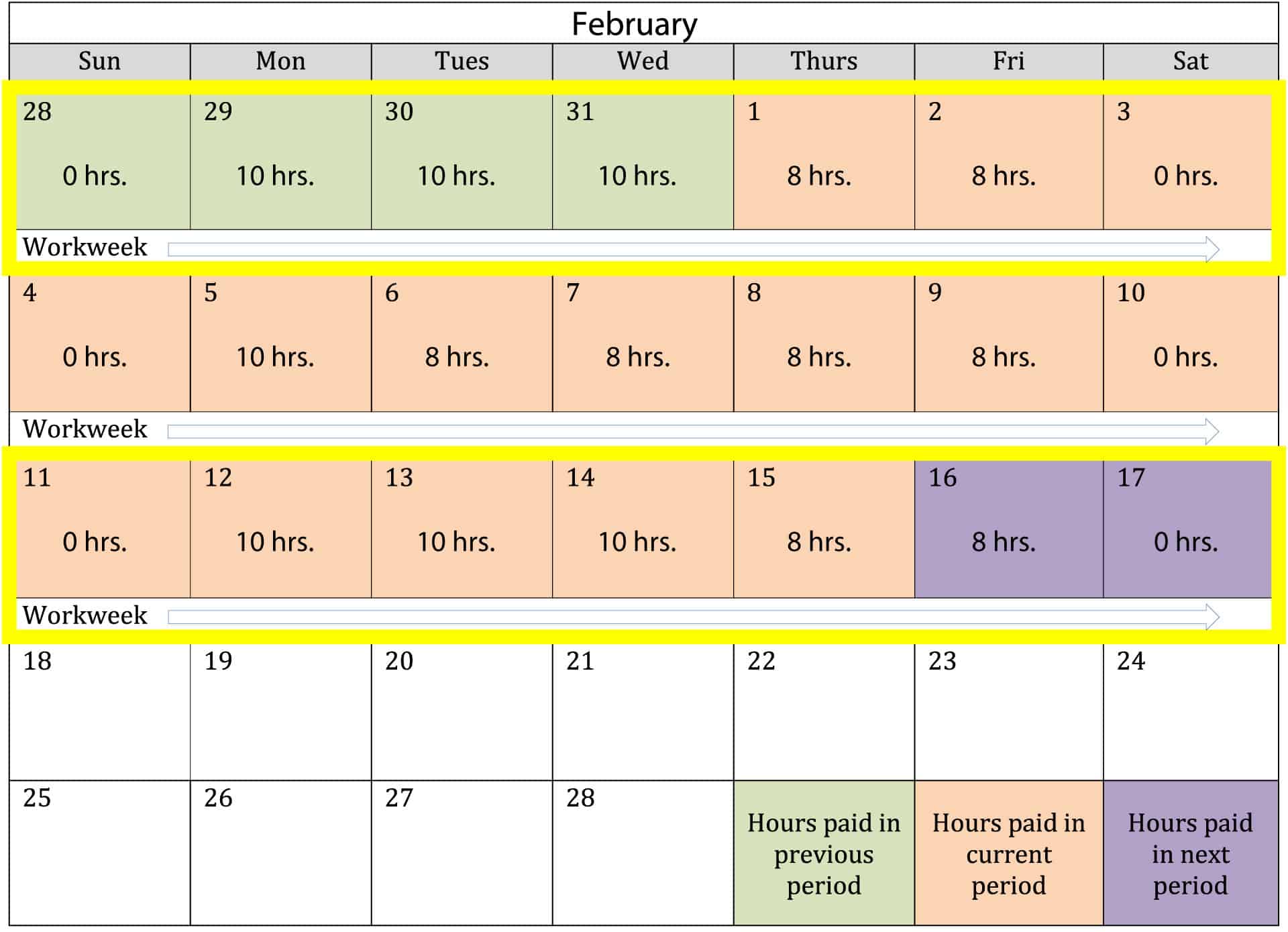

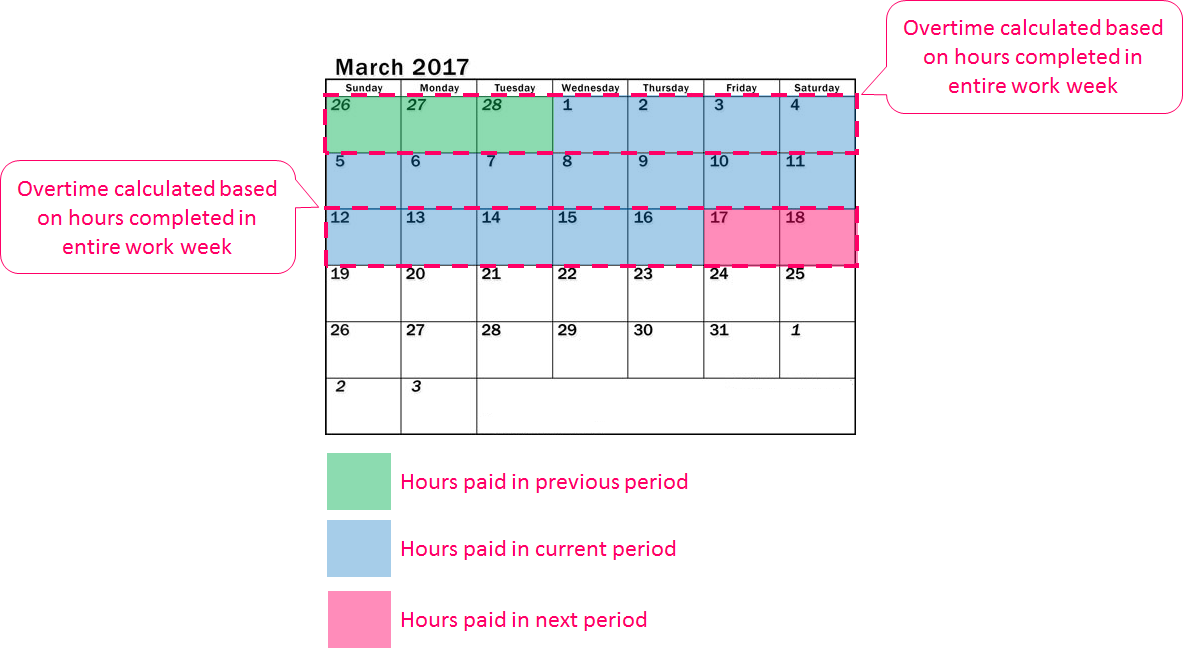

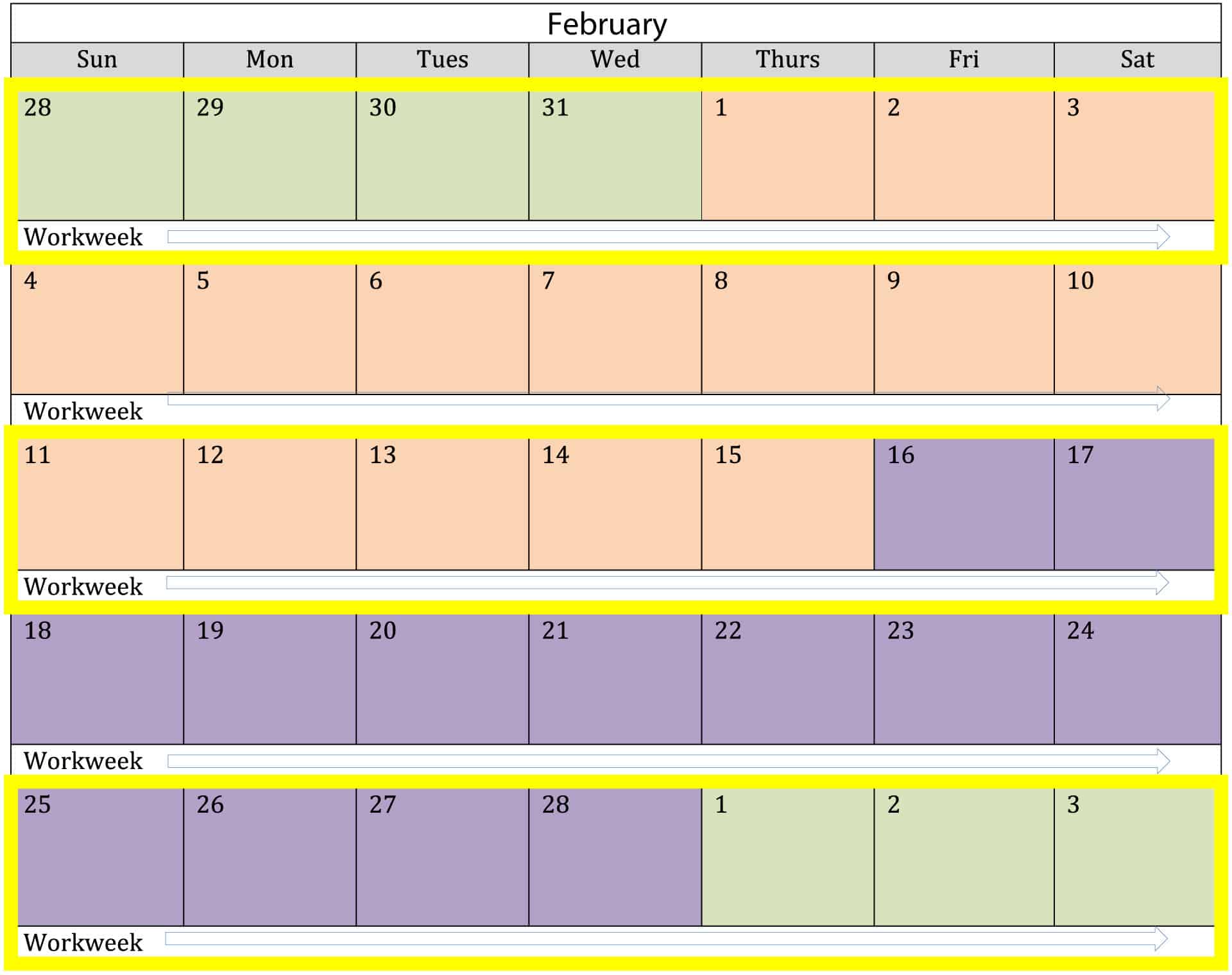

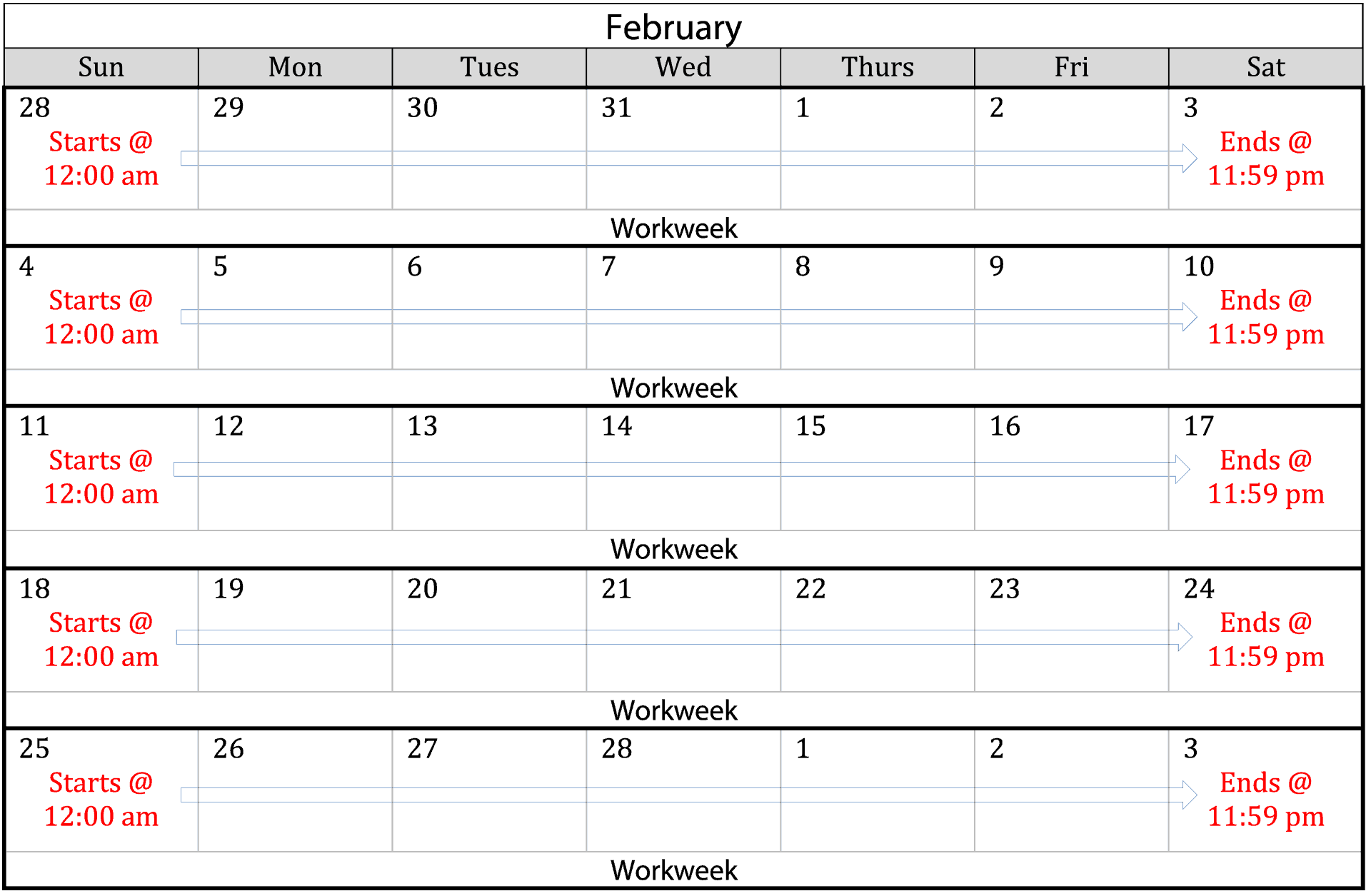

For example 50000 divided by 24 pay periods comes to 208333 which is her semi-monthly. How to Calculate a Semi-Monthly Paid Employees Daily Rate How to Calculate Overtime for a Semi-monthly Payroll 1.

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

Prorated Salary Easy Guide Calculator Hourly Inc

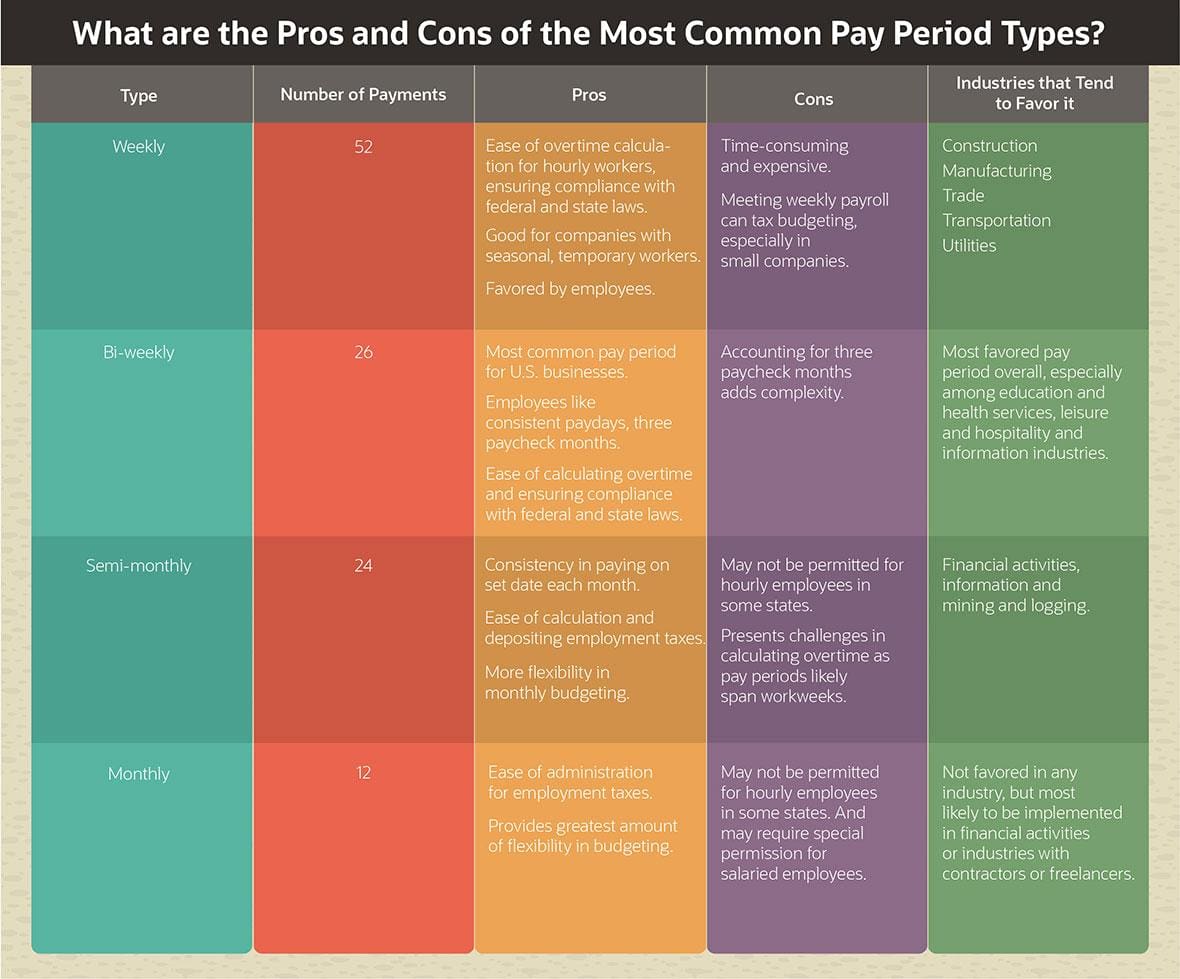

What Is A Pay Period Types Considerations And How To Choose Netsuite

Elaws Flsa Overtime Calculator Advisor

What Is A Pay Period Free 2022 Pay Period Calendars

The Pros And Cons Biweekly Vs Semimonthly Payroll

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

Semi Monthly Pay Period Timesheet Mobile

4 Ways To Calculate Annual Salary Wikihow

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

What Is A Pay Period How Are Pay Periods Determined Ontheclock

What Is A Pay Period Free 2022 Pay Period Calendars

How To Calculate Pay Using The State Formula Rate Mit Human Resources

How To Set Up Pay Periods To Work With Pay Dates Ontheclock

Difference Between Bi Weekly And Semi Monthly Difference Between

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

9 Payroll Schedule Templates Word Docs Free Premium Templates